In the digital age, the volume of data generated daily is staggering. This vast amount of information, known as big data, has become a crucial resource in various fields, including investigative services. Big data analytics is transforming how fraud is detected and prevented, offering unparalleled insights and enhancing the effectiveness of investigative efforts.

This blog outlines how big data analytics can be leveraged by investigative services for fraud detection and prevention.

Enhancing Fraud Detection

Identifying Patterns and Anomalies

Big data analytics enables the detection of patterns and anomalies that could indicate fraudulent activities. By analyzing large datasets, investigators can identify unusual behavior, such as irregular transaction patterns or atypical user activity. These insights allow for the early detection of potential fraud, enabling prompt action to mitigate risks.

Real-Time Monitoring

One of the significant advantages of big data analytics is real-time monitoring. Investigative services can leverage analytics tools to continuously monitor transactions and activities, providing immediate alerts when suspicious behavior is detected. This proactive approach ensures that fraud is identified and addressed as soon as it occurs, minimizing potential damage.

Improving Fraud Prevention

Predictive Analytics

Predictive analytics, a subset of big data analytics, uses historical data to forecast future events. In fraud prevention, predictive models can identify trends and predict potential fraud risks before they materialize. By understanding these patterns, organizations can implement preventive measures to protect against future fraud attempts.

Risk Assessment

Big data analytics enhances risk assessment by providing a comprehensive view of potential vulnerabilities. By analyzing various data points, such as transaction histories, user behavior, and external factors, investigators can assess the likelihood of fraud and prioritize areas that require more stringent controls. This targeted approach improves the overall effectiveness of fraud prevention strategies.

Benefits of Investigative Services

Enhanced Efficiency

Big data analytics significantly enhances the efficiency of investigative services. Automated data analysis reduces the time and effort required to sift through large volumes of information. Investigators can focus on high-priority cases and make more informed decisions based on data-driven insights.

Data-Driven Decision Making

Data-driven decision-making is a cornerstone of effective fraud detection and prevention. Big data analytics provides investigators with accurate and actionable information, enabling them to develop strategies based on empirical evidence rather than intuition. This approach leads to more robust and reliable outcomes in fraud investigations.

Final Thoughts

The integration of big data analytics into fraud detection and prevention represents a significant advancement in the field of investigative services. By leveraging the power of big data, investigators can identify and address fraudulent activities more efficiently and effectively. As technology continues to evolve, the role of big data analytics in combating fraud will undoubtedly become even more critical, offering enhanced protection for organizations and individuals alike.

Nip All Scams and Frauds in the Bud with Investigative Services from JP Investigations

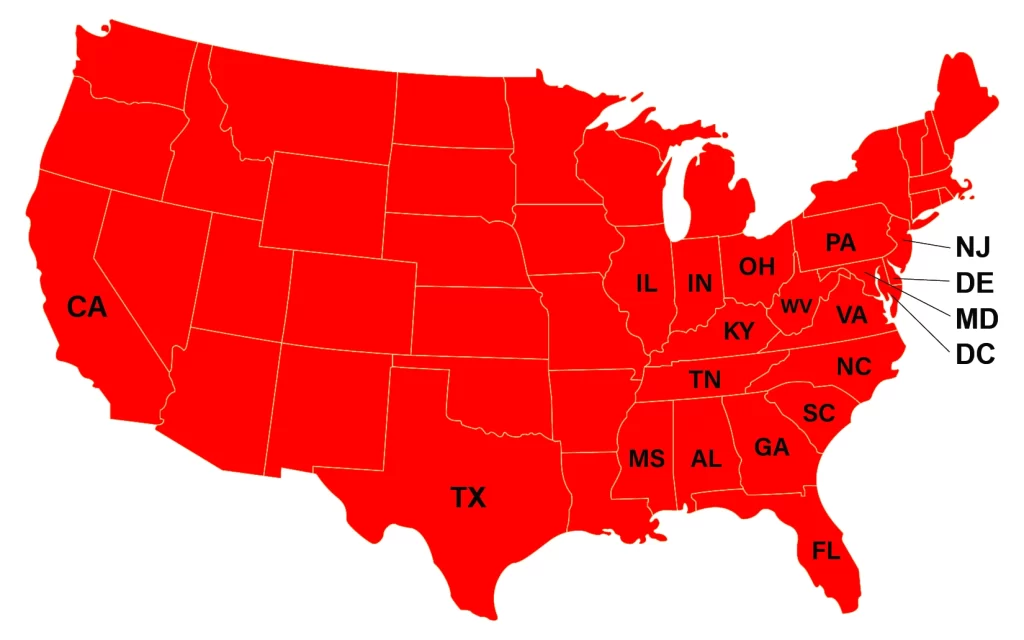

Protect your business with JP Investigations. Our expert team uses advanced big data analytics to detect and prevent fraud. Whether it’s a criminal investigation or a corporate investigation, trust the best investigative services in South Carolina to safeguard your interests and ensure peace of mind. Contact us today!